Social Security Protection (Socso)

Provider By

SOCIAL SECURITY ORGANISATION (Perkeso)

Shared By

Malaysia Medical Insurance Organization (MMI)

+603-92863323

EMPLOYMENT INJURY SCHEME BENEFITS

(Updated 25 October 2016)

1) MEDICAL BENEFIT [ + ]

Employees suffering from employment injuries or occupational diseases may receive free medical treatment at SOCSO’s panel clinic or Government clinic / hospital. Treatment must be continued until they are fully recovered.

2) TEMPORARY DISABLEMENT BENEFIT [ + ]

Temporary Disablement Benefit is paid for the period the employee is on medical leave certified by a doctor for not less than four (4) days including the day of accident. However, Temporary Disablement Benefit will NOT be paid for the days for which the employee works and earns wages during this period.

3) PERMANENT DISABLEMENT BENEFIT [ + ]

Permanent Disablement is defined as a permanent disability due employment injury that reduces employees’ ability to perform his duites. The employee can claim this benefit after the last day of temporary disablement.

4) CONSTANCE-ATTENDANCE ALLOWANCE [ + ]

This allowance is paid to an employee who is suffering from total permanent disablement and is so severely incapacitated as to constanly require the personal attendance of another person.

5) FACILITIES FOR PHYSICAL OR VOCATIONAL REHABILITATION [ + ]

Rehabilitation facilities may be provided free of charge by the Organisation to an employee who suffers permanent disablement

6) RETURN TO WORK PROGRAMME [ + ]

SOCSO’s Return to Work (RTW) program was introduced on the 15th of January 2007 for Insured Person suffering from employment injury or claiming to be invalid. The Return to Work program involves a proactive approach taken in helping Insured Person with injuries or diseases, opportunities to safe and productive work activities as soon as it is medically possible or when maximum medical improvement is achieved with a primary focus of minimizing the impact of injuries or disabilities.

7) DEPENDANTS’ BENEFIT [ + ]

If an employee dies as a result of employment injury, his dependants are eligible to this benefit.

8) FUNERAL BENEFIT [ + ]

Funeral Benefit will be paid to the eligible person as prescribed in the Act, if the employee dies due to any cause. In the absence of such person, the benefit will be paid to the person who actually incurs the expenditure.

9) EDUCATION BENEFIT [ + ]

Education Benefit is a SOCSO benefit that can come in the form of education benefits or scholarships to dependent beneficiaries based on PERKESO’s Benefits Schedule and meets the SOCSO’s requirement.

MEDICAL BENEFIT

Employees suffering from employment injuries or occupational diseases may receive free medical treatment at SOCSO’s panel clinic or Government clinic / hospital. Treatment must be continued until they are fully recovered.

For serious injuries, medical care may be obtained from the Government hospital and the employee is eligible for second class ward treatment. Specialist treatment will be provided, if required.

Medical treatment at SOCSO Panel Clinics

To receive free medical treatment, employers must submit the following documents to any SOCSO panel clinics during the first treatment:

Borang Butiran Notis dan Tuntutan Faedah – Form 34

Letter of identity from employer

Letter of identity is prepared by the employer in the instances when Form 34 cannot be completed in time for the employee to receive their first treatment at the SOCSO panel clinics, due to serious or critical injuries. Letter of identity should state:

The patient is an insured person under the employment of the employer

The employee had an accident during the course of work

Form 34 will be presented as soon as possible to the panel clinic.

Reimbursement of Medical Claims

In the case of medical treatments received from non SOCSO’s panel clinics, employees or employers are eligible to make reimbursement of medical claims, subject to such condition as maybe determined by the Organisation.

Claims need to be supported with the following documents:

Claim for medical treatments (Form PKS (P) 24)

Claim for general expenses (Form PKS (P) 26)

Original receipts

A copy of the Appointment Card

A copy of the medical report (if needed)

TEMPORARY DISABLEMENT BENEFIT

Period Of Temporary Disablement

Temporary Disablement Benefit is paid for the period the employee is on medical leave certified by a doctor for not less than four (4) days including the day of accident. However, Temporary Disablement Benefit will NOT be paid for the days in which the employee works and earns wages during this period.

Eligibility

Employee must be an insured person under the Act

Accident that occurs to an employee must arise out of and in the course of employment

A Police report is required if an accident occurs to an employee while commuting for employment purposes

Benefits shall be paid based on the days of medical leave that is certified by a doctor. However temporary disablement benefit will NOT be paid for the days in which the employee work and earn wages during this period.

Rate Of Temporary Disablement Benefit

Payment rate is equivalent to 80% of the assumed average daily wage of the insured person

i. The assumed average daily wage is calculated as one-thirtieth (1/30) of the assumed average monthly wages for the insured person

ii. The assumed average monthly wages is equivalent to the sum of the assumed monthly wages for each of the months for which contributions of the first or second category have been paid or were payable during the continuous period of 6 months immediately preceeding the month in which the employment injury occurred, divided by the number of months for which such contributions were so paid or payable

The daily rate is subject to the following:

i. Minimum of RM30.00 per day (w.e.f. 1 January 2014)

ii. Maximum of RM105.33 per day

Documents To Be Submitted For Claims

‘Borang Butiran Notis dan Tuntutan Faedah’ – Form 34

Photocopy Of Identity Card (both sides)

Original Medical Certificate / Form 13 (Panel Clinic)

Photocopy Of Punch Card / Attendance Record / Employer’s verification letter in the absence of punch card

Letter Of Consent for obtaining medical report from Hospital.

PERMANENT DISABLEMENT BENEFIT

Permanent Disablement is defined as a permanent disability due to employment injury that reduces employee’s ability to perform his duty. The employee can claim this benefit after the last day of temporary disablement.

Determining the Question of Permanent Disablement

Assesment regarding permanent disability of an insured person can only be decided by the following authorities:-

Medical Board

Specialist Medical Board (for Occupational Disease)

Medical Appeal Board (if an Insured Person or SOCSO is not satisfied with the diagnosis made by the medical board

Application to refer to Medical Board

References to the medical board can be made by the following persons:-

Insured Person who have completed their medical leave and is permanently disabled

Employer

Registered Trade Union representative

SOCSO is also allowed to refer insured person to the Medical Board if the medical leave is more than 180 days.

The time limit for any application to refer to the Medical Board is twelve months from the date of:

a. Last date of temporary disability

b. Employment injury if it does not involve any loss of disablement

c. Decision made by the Social Security Appellate Board to accept and allow the temporary disablement claims made subsequent to SOCSO rejecting such claims

References To Appellate Medical Board

Appeals to the Medical Appellate Board must be made within 90 days from the date of assessment by the Medical Board to the insured person.

Assessment And Payment

Claims will be referred to the Medical Board for permanent disability assessment.

1) If the assessment does not exceed 20%

Payment can be made in the form of lump sum.

2) If the assessment exceeds 20%

the employee is given an option to commute 1/5 of daily rate of the benefit into a lump sum payment while the balance will be paid monthly for life.

However, the option of lump sum payment is subjected to the aggregate loss of earning capacity as a replacement to any lump sum payment not exceeding 20%, if claims were previously made by the insured person

Rate Of Payment

1) Daily rate for Permanent Disablement Benefit is based on 90% of assumed average daily wage of the insured person

The assumed average daily wage is calculated as one-thirtieth (1/30) of the assumedaverage monthly wages for the insured person

The assumed average monthly wage is equivalent to the sum of the assumed monthly wages for each of the months for which contributions of the first or second category have been paid or were payable during the continuous period of 6 months immediately preceeding the month in which the employment injury occurred, divided by the number of months for which such contributions were so paid or payable

2) Daily rate of Permanent Disablement Benefit is subject to:

Minimum of RM30.00 per day (w.e.f. 1January 2014)

Maximum RM118.50 per day

How To Claim

Application for permanent disablement benefit must be made in writing through SOCSO office with the following document:

Application letter

Photocopy Of Identification Card

Latest Medical Report

CONSTANT-ATTENDANCE ALLOWANCE

This allowance is paid to an employee who is suffering from total permanent disablement and is so severely incapacitated as to constanly require the personal attendance of another person.

Eligibility

An insured person who is 100% permanently disabled and certified by Medical Board or Special Medical Board or the Appellate Medical Board is eligible for this allowance.

Rate Of Payment

The allowance is equivalent to 40% of the rate of permanent total disablement benefit subject to maximum of RM500 per month (Effective on 1st January 2013, the rate of this allowance is fixed at RM500 per month).

FACILITIES FOR PHYSICAL OR VOCATIONAL REHABILITATION

Rehabilitation facilities may be provided free of charge by the Organisation to an employee who suffers permanent disablement. Amongst the facilities provided are :

1. Physical rehabilitation includes:

Return To Work programme

Occupational therapy

Reconstructive surgery

Artificial limbs and prosthetics

Orthopaedic aids such as wheel chairs, walking stick, hearing aids

Return To Work Programme

Physiotherapy

2. Vocational rehabilitation includes:

Training in selected areas such as electrical wiring, sewing, radio / TV repair, air conditioner and fridge repair, plumbing, stenography , secretarial skills and others.

Return To Work programme

RETURN TO WORK PROGRAMME (RTW)

INTRODUCTION

SOCSO’s Return to Work (RTW) program was introduced on the 15th of January 2007 for Insured Person suffering from employment injury or claiming to be invalid. The Return to Work program involves a proactive approach taken in helping Insured Person with injuries or diseases, opportunities to safe and productive work activities as soon as it is medically possible or when maximum medical improvement is achieved with a primary focus of minimizing the impact of injuries or disabilities.

Return to Work program is a collaborative process that facilitates recommended efficient treatment plans to assure that appropriate medical care is provided to Insured Person with injuries or diseases to ensure an early and safe return to work. The program requires careful planning and coordination with appropriate health care service providers to achieve the rehabilitation goal where the processes involved are facilitated by a case manager who manages the implementation and coordination of the rehabilitation plan with healthcare providers, as well as the clients while promoting cost-effective care.

The implementation of an effective disability management system relies on the partnership involving various stakeholders such as the employers, employees, health care providers, rehabilitation service providers, government agencies, non-government organizations, and various bodies to achieve an effective.

RETURN TO WORK OBJECTIVE

To assist Insured Person with injuries or disease to return to work in a safe and fast manner

To carry out SOCSO’s social responsibility towards employers and employees

To create a positive working environment through communication and support for employees with disabilities

To reduce and minimize the potential of repetitive accidents at the workplace

To reduce disability duration

To increase the productivity of employees with disabilities through total replacement of income

BENEFITS TO EMPLOYER

To reduce the disability duration of Insured Person with injuries or diseases and enable a safe and fast return to work and increasing productivity thereafter

To be able to retain experienced and highly skilled workers at the work place

To reduce training and hiring costs of temporary workers

To optimize the employees’ rehabilitation period so they can return to work faster and increase their productivity

To provide work modification recommendations to accommodate employees with injuries or diseases

BENEFITS TO EMPLOYEES

To provide psychological support through counselling and consultation• To restore employee’s self-confidence by enhancing their physical and mental ability and to prevent low self-esteem caused by the illness or disability

To provide appropriate rehabilitative equipment’s including orthotic, prosthetic, implants and so forth, based on the prescription given by the treating doctors or specialists

Promotes speedy recovery and reduces the impact on the quality of life due to the disability or illness

REFERRAL PROCESS

The first step of the disability management process starts with the referral processes whereby cases will be referred from various sources including SOCSO’s Medical Board / Appealate Board and the Special Appealate Medical Board, doctors and employers following which these cases will be screened by the case managers if the following criterias are met:

Insured Person with employment injury and is receiving temporary disablement benefits

Insured Personwho has applied for permanent disablement benefits and has been referred for the Return to Work

Program by the medical board

Insured Person aged below 50 and has been certified not invalid and has been referred for the Return to Work

Program by the medical board

Insured Person aged below 40 who has been certified invalid but is still interested to return to work

DEPENDANTS’ BENEFIT

If an employee dies as a result of employment injury, his dependants are eligible to this benefit.

Eligibility

Employees must be an insured person under the Act

Death that occurs to an employee must arise out of and in the course of employment

Dependants as prescribed under the Act as stated below:-

Widow Or Widower, child;

If there are no widow or widower, child

a. Brothers or sisters

b. Parents

c. Grand Parents (in the case of the insured person’s parents are deceased)

Note :

Child in this context refers to a child who is aged less than 21 years of age at the time of death of the insured person (exception for a child who is mentally retarted or physically incapacitated and is incapable of supporting himself), inclusive of:

Biological child

Step child under the care of the Insured Person

Legally adopted child of the Insured Person

Biological child out of wedlock

Brothers or sisters are defined as biological brothers or sisters aged less than 21 years of age at the time of death of the insured person.

Rate Of Payment

Daily rate for Dependants Benefit is based on 90% of assumed average daily wage of the insured person

The assumed average daily wage is calculated as one-thirtieth (1/30) of the assumed average monthly wages for the insured person

The assumed average monthly wage is equivalent to the sum of the assumed monthly wages for each of the months for which contributions of the first or second category have been paid or were payable during the continuous period of 6 months immediately preceeding the month in which the death occurred, divided by the number of months for which such contributions were so paid or payable

Daily rate of Dependants Benefit is subject to :-

a ) Minimum of RM30.00 per day (w.e.f. 1 January 2014)

b ) Maximum of RM118.50 per day (w.e.f 1 June 2016)

Dependants And Daily Rate

The daily rates for dependants’ benefit is based on the following priorities:-

Please refer as below

http://www.perkeso.gov.my/en/dependant-s-benefit.html

Documents To Be Submitted For Claims

Applicants or parties claiming on behalf of the dependant must produce the following documents:

Borang Butiran Notis dan Tuntutan Faedah – Borang 34

Insured Person’s Death Certificate

A copy of the Insured Person’s Identification Card

Others document :

a. In the case of widow, widower or child, applicants or representatives claiming on behalf of the dependant must produce the following documents :

Marriage Registration or Solemnising Certificate (Sijil Nikah)

A copy of the widow or widower’s Identification Card

A copy of the child’s birth certificate for those below the age of 21

A copy of the applicants or parties claiming on behalf of the dependant’s bank account passbook

In the case of parents, sibling or grand parents, applicants or representatives claiming on behalf of the dependant must produce the following documents:

A copy of the Insured Person’s birth certificate

A copy of the parent’s Identification Card

A copy of the sibling’s birth certificate for those below the age of 21

A copy of the applicants or representatives claiming on behalf of the dependant’s bank account passbook

FUNERAL BENEFIT

Funeral Benefit will be paid to the eligible person as prescribed in the Act, if the employee dies as a result of employment injury or while he/she is in receipt of disablement benefit. In the absence of such person, the benefit will be paid to the person who actually incurs the expenditure. The amount paid will be the actual amount incurred or RM1,500 whichever is lower.

Funeral Benefit will be paid out to the following, based on priority:

i. widow (if there are more than one widow, the benefitt will be equally shared amongst the widows)

ii. widower

iii. eldest son

iv. eldest daughter

v. parents ( if both parents are still alive, the benefit will be equally shared )

In the case that there are no one eligible based on the above criteria, the benefit will be extended to the party that incurred the funeral arrangement of the Insured Person. However, the amount will be limited to RM1,500.00 and based on actual cost incurred, and supported with receipts as proof.

Documents To Be Submitted For Claims

Claimant must submit the following documents:

Borang Butiran Notis dan Notis Tuntutan Faedah – Borang 34

A copy of the funeral permit / Death Certificate

A copy of the Insured Person’s Identification Card

A copy of the claimant’s Identification Card

EDUCATION BENEFIT

Education Benefit is a SOCSO benefit that can come in the form of education benefits or scholarships to dependent beneficiaries based on PERKESO’s Benefits Schedule and meets the following requirement to qualify:

A. APPLICANT REQUIREMENTS TO QUALIFY [ + ]

B. EDUCATION BENEFIT FUNDING DETAILS [ + ]

C. HOW TO APPLY EDUCATION LOAN [ + ]

D. EDUCATION LOAN ALLOCATION [ + ]

E. EDUCATION BENEFIT AGREEMENT DOCUMENTS [ + ]

F. LOAN DISBURSEMENT METHODS [ + ]

G. EDUCATION LOAN REPAYMENT INSTALLMENT [ + ]

H. CHANNELS TO PAY THE EDUCATION BENEFIT [ + ]

Service Charge SOCSO Education Loan

Effective 1st January 2013, service charge education loan for all borrowers who received education loan offered before 1st January 2009 has been reduced from 4% to 2%.

Meanwhile, for new borrowers who received education loan offered after 1st January 2009, services charged still remain at 2%.

For more information, please logo on link as below

The official Website of

SOCIAL SECURITY ORGANISATION

“Sikap Terbuka Layanan Mesra”

Customer Service : 1-300-22-8000

General Line : 03 – 4264 5000

Fax : 03 – 4256 7798

E-mail : perkeso@perkeso.gov.my

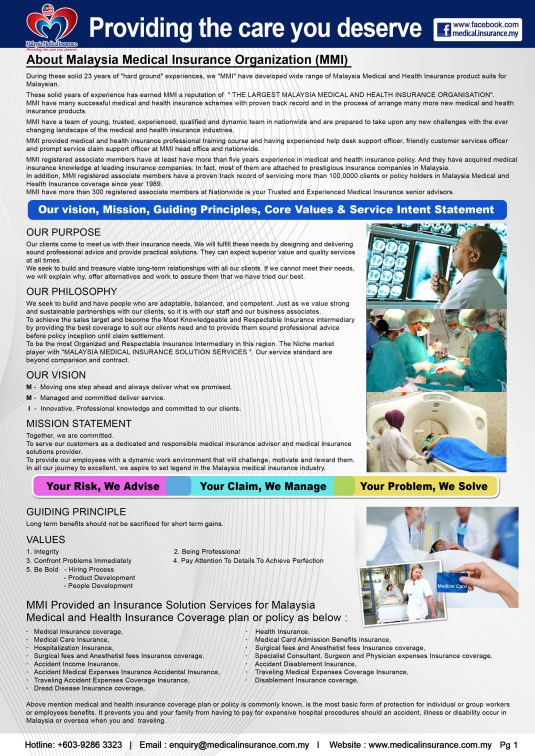

Shared By Malaysia Medical Insurance Organization (MMI)

Ad Sharing

Your Trusted Malaysia Medical Insurance Risk Management Advisory Provider.

Malaysia Medical Insurance Organization (MMI)

Head Office,

158-3-7, BLOK 158, KOMPLEKS MALURI,

JALAN JEJAKA, TAMAN MALURI,CHERAS,

55100 KUALA LUMPUR, MALAYSIA.

MMI careline +603-92863323

mmicare@medicalinsurance.com.my

Group Hospitalisation And Surgical Fees & Group Employees Medical Insurance Policy

Arranged by

Malaysia Medical Insurance Organization (MMI)

mmicare@medicalinsurance.com.my

+603-92863323

Group Hospitalisation And Surgical Fees & Group Employees Medical Insurance

Group Hospital & Surgical Insurance

– No Co Insurance

– Guarantee Renewal up to Age 100

– High Lifetime Limit up to RM 10,000,000

– 24 Hours Worldwide Coverage

– Hassle Free Cash Less Hospital Admission

– High Coverage As Charged or Full Reimbursement

– Hospital Supplies & Services

– Physician Fees & Specialist Visit Fees

– Surgical Fees / Anaesthetist Fees

– Operating Theatre

– Intensive Care Unit (ICU)

– Pre-Hospital Diagnostic Tests

– Pre-Hospital Specialist Consultation

– Post Hospitalisation Treatment

– Ambulance Fees

– Prescription Drugs

– Out Patient Accidental Treatment & Pysiotheropy Treatment

– Nursing, Theatre Consumables & Other Ancillary Charges

– Insured Child’s Daily Guardian Benefits

– Out Patient Kidney Dialysis Treatment

– Out Patient Cancer Treatment

– Home Nursing Care

– Take Over Policy for Waiver of Waiting Period, Pre-Existing Illness & Specified Illness

– International Emergency Medical Assistance Services

– Comprehensive Coverage & Complete Medical Care Benefits

– Inpatient & Day Surgery

Recent Comments