Manufacturing Insurance and Warehouse Insurance Malaysia Hotlime +6011-12239838

23 May 2019 Leave a comment

in AIG Marine and Cargo Insurance, Allianz Marine Insurance Malaysia, axa marine cargo insurance, Contractor Plant & Machinery Insurance Malaysia, Factory Insurance Malaysia, kurnia marine cargo insurance, lonpac marine cargo insurance, Machinery All Risk Insurance Malaysia, Machinery Leasing Insurance Malaysia, Manufacturing Insurance Malaysia, Marine and Cargo Insurance Kuala Lumpur, Marine Shipping Insurance, Marine Shipping Insurance Malaysia, Uncategorized Tags: AIG Factory Insurance, AIG Manufacturing insurance, Allianz Factory Insurance, Allianz Manufacturing insurance, AXA factory insurance, AXA Manufacturing insurance, factory insurance, Factory Insurance Klang, Factory Insurance Malaysia, Kurnia Manufacturing insurance, Lonpac Factory Insurance, Lonpac Manufacturing insurance, manufacturing insurance, Manufacturing Insurance Malaysia, MSIG Factory Insurance, MSIG Manufacturing insurance, pacific Manufacturing insurance, Tokio Marine Factory Insurance, tokio marine Manufacturing insurance

Marine Shipping Insurance Malaysia, Logistic Insurance Malaysia, Marine Cargo Insurance Malaysia, Inland Transit Insurance Malaysia, Goods In Transit Insurance Malaysia

30 May 2016 Leave a comment

in A Permit Lorry Motor Insurance Malaysia, Burglary Insurance Kuala Lumpur, C Permit Lorry Motor Insurance Malaysia, Commercial Car Insurance Kuala Lumpur, Commercial Van Motor Insurance Malaysia, Factory Insurance Malaysia, Fire and Water Damage Insurance Malaysia, Foreign Worker Insurance Kuala Lumpur, Goods In Transit Insurance Kuala Lumpur, Group Accident Insurance Kuala Lumpur, Group Employees Medical Insurance Malaysia, Group Medical Insurance Kuala Lumpur, Inland Transit Insurance Malaysia, Logistic Insurance Malaysia, Machinery All Risk Insurance Malaysia, Manufacturing Insurance Malaysia, Marine and Cargo Insurance Kuala Lumpur, Marine Shipping Insurance, Warehouse Insurance Malaysia, Workmen Accidental Insurance Kuala Lumpur, Workmen Compensation Insurance Malaysia Tags: AIG Marine Cargo Insurance, Allianz Marine Cargo Insurance, axa marine cargo insurance, Burglary Insurance, Factory Insurance Klang, Fire Insurance, goods in transit insurance malaysia, kurnia marine cargo insurance, Logistic Insurance Malaysia, Lonpac Goods In Transit Insurance, Manufacturing Insurance Malaysia, marine cargo insurance malaysia, marine cargo insurance selangor, Marine Insurance, Marine Shipping Insurance Malaysia, MSIG Manufacturing insurance, MSIG Marine Cargo Insurance, Shipment Insurance, Shipping Insurance Port Klang, Tokio Marine Inland Transit Insurance, Warehouse Insurance Klang

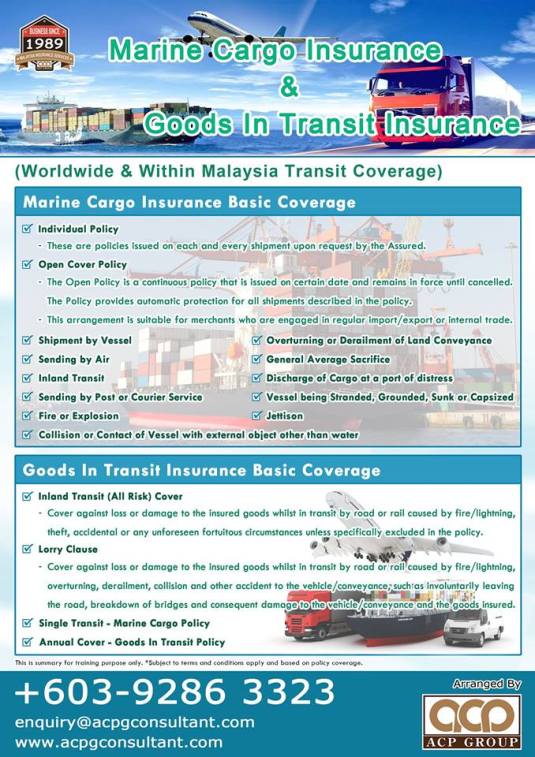

Marine Shipping Insurance Malaysia, Logistic Insurance Malaysia, Marine Cargo Insurance Malaysia, Inland Transit Insurance Malaysia, Goods In Transit Insurance Malaysia

Arranged By

ACPG Management Sdn Bhd

+603-92863323

Cargo insurance

What is Marine cargo insurance?

Marine cargo insurance covers the risks of loss or damage to goods and merchandise while in transit by any method of transport – sea, rail, road or air – and while in storage anywhere in the world between the points of origin and final destination. We have a number of marine cargo products to suit the needs of Small to Medium Enterprises. Find our individual solutions below. Or find information marine cargo for large and multinational business.

Why do we need marine insurance?

Most marine cargo shipments arrive at their destinations without an issue, and it’s easy to think that insurance is a discretionary cost in the logistical process. However, time and time again we hear in the news that the unexpected does indeed happen. If a vessel is lost at sea and your cargo can’t be salvaged, insurance cover will help protect you from financial and commercial loss.

Marine insurance is complex and needs to navigate legal principles from a number of legislative areas – domestic and international law to begin with, but also maritime law. Marine insurance experts stay abreast of these areas and know the intricacies of marine commerce and its many clauses, helping clients to risk manage their shipments and to have peace of mind in their daily operations.

A marine cargo policy is usually an annual policy tailored to suit the shipper’s needs. They range from basic protection against loss of goods through to more comprehensive policies which protect against loss of sales and provide for goods to be shipped as replacements. Marine insurance can also be taken out on a shipment-by-shipment basis.

Who needs marine insurance?

No matter what business you are in, chances are you will be shipping or receiving goods as part of your value chain. Marine insurance covers the process of moving cargo by sea, road, rail and air, as well as any storage the goods may require in between. As such, it is of vital interest for a broad range of businesses.

Manufacturers – importing raw materials and distributing finished goods

Wholesalers – importing stock and distributing sales

Primary producers – exporting products like beef, lamb, fish and cotton etc.

Miners – exporting coal, iron ore or bauxite

Retailers – importing stock and moving sales, purchases and stock transfers

Repairers – importing spare parts and sending customers’ goods.

Single Transit Insurance (within Malaysia)

Single Transit Insurance (within Malaysia) is for ‘one off’ consignments of goods (other than home removals) or livestock within Malaysia.

Our Single Transit (within Malaysia) has a broad, market-leading and competitive cover.

Goods or livestock can be insured for loss or damage during any transit within Malaysia.

Goods in Transit Insurance

Goods in transit insurance is an annual cover where premium is based on the value of goods in transit, at the insured’s risk, during the policy period. It is the simplest and most convenient way to cover the insured’s inland transit risks.

Either all risks of loss or damage or defined events for goods or death by natural and accidental causes or accidental causes only for livestock can be covered.

Goods in Transit Insurance (own vehicles)

Goods in Transit Insurance (own vehicles) is a simple and inexpensive annual cover for major transit risks and theft of goods carried in any vehicle owned and/or operated by the insured and is not restricted to nominated vehicles.

It is particularly suited to small businesses and farmers with one or more vehicles used to collect or deliver goods or livestock.

Annual premium is calculated on the number of vehicles operated, type of goods/livestock carried and the nominated sum insured.

Goods in Transit (Carriers) Insurance

Goods in Transit (Carriers) Insurance provides the carrier with the ability to have commercial settlements made to their customers for loss or damage to their goods or livestock from an insured event at the carrier’s request, irrespective of their liability. If the carrier chooses not to accept the customer’s claim, the policy remains in force, with agreed legal costs covered, should the carrier elect at a later time to accept the claim.

This cover is available to all carriers – there is no requirement for the carrier to issue consignment notes or operate under other contracts of carriage.

This policy offers two levels of cover:

Comprehensive – against loss or damage to goods from accident or deliberate act of a third party or death of livestock from accident, natural causes or humane slaughter

Defined events – against loss or damage to goods or death of livestock from major transit perils including fire, flood, collision, overturning, impact.

Defined events cover can be optionally extended to cover:

Theft, pilferage, non-delivery

Accidental loss or damage during loading or unloading deterioration of refrigerated goods from breakdown or mismanagement of refrigerating machinery.

Specified Items in Transit Insurance

Specified Items in Transit Insurance is a simple and inexpensive annual cover for major transit risks and theft of specified goods regularly transported on any registered road vehicle or trailer.

This product is particularly suitable for tools of trade, mechanical and/or electronic equipment, musical instruments, computers or other equipment, eg racing cars or boats, suitable for tradesmen, professional people, small businesses, sporting groups, schools and associations. Premium is based on the type of specified items carried and the nominated sum insured.

Annual Marine Cargo Insurance

Annual marine cargo premium is based on the value of all shipments that the insured is responsible to insure. It is the simplest and most convenient way to cover the insured’s import and export risks.

Our Annual Marine Cargo policy has a broad, market-leading and competitive cover incorporating internationally recognised Institute Clauses with our own special conditions and additional clauses.

Cargo is insured for loss or damage during import, export and within Malaysia transit.

Stock and equipment at exhibitions or while on display can also be covered under the policy.

Single Marine Cargo Insurance

Single marine cargo insurance is for ‘one-off’ insurance cover for import or export shipments, except home removals.

Our Single Marine Cargo has a broad, market-leading and competitive cover incorporating internationally recognised Institute Clauses with our own special conditions and additional clauses.

Cargo is insured for loss or damage during import, export including within the Malaysia leg of the journey.

Carriers Cargo Liability Insurance

Carriers Cargo Liability Insurance protects a carrier who operates using approved consignment notes or other contracts of carriage against their liability, in terms of these contracts, for loss or damage to their customers’ goods or livestock.

This cover is a relatively inexpensive way for the carrier who manages their risk contractually to protect them. Agreed legal costs incurred to defend claims against the carrier are covered.

Carriers Cargo Liability policy also extends to cover delay, loss of market or consequential loss caused solely by loss or damage to the insured goods or livestock. This cover is only limited to the difference between the amount paid for damage to the goods and the limit sum insured, not a small sub-limit.

Home Removals Insurance

Are you planning a move? If you are using professional removalists to help you get into your new home faster, you can cover your household goods with comprehensive door-to-door insurance.

Moving house is considered by many to be one of life’s most stressful situations. The pressure is heightened when the move is to a different country.

We can help you take some of the stress away by providing one of the most comprehensive home removals insurance solutions.

Our home removals insurance has been designed to cater for every level of cover and budget. You can cover your household goods and personal effects while in transit and also while in storage – providing seamless protection for precious goods and personal effects.

This policy is suitable for:

Families or individuals moving within Malaysia.

Families or individuals moving from anywhere in Malaysia to selected destinations overseas.

Malaysia Experience General Insurance Risk Management Solution Provider since year 1989.

ACPG Management Sdn Bhd

Head Office

158-3-7, Blok 158, Kompleks Maluri,

Jalan Jejaka, Taman Maluri,

55100 Kuala Lumpur, Malaysia.

+603-92863323

Recent Comments