Legal Liability Insurance Malaysia (Hotline +603-92863323)

Legal Liability Insurance Malaysia (Hotline +603-92863323)

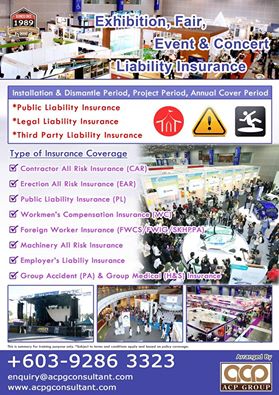

Public Liability Insurance, Personal Liability Insurance,

Business Liability Insurance, Third Party Liability Insurance,

Product Liability Insurance, Professional Indemnity Insurance,

Building Management Liability Insurance, Liability Insurance,

Employer’s Liability Insurance, Errors & Omission Insurance,

Renovation Liability Insurance, Contractor Liability Insurance, Installation Liability Insurance, Signboard Liability Insurance, Roadside Banner Liability Insurance, Event Liability Insurance, Exhibition Liability Insurance, Concert Liability Insurance, Retail Premises Liability Insurance, Restaurant Premises Liability Insurance, Food Poisoning Liability Insurance

Arranged By

ACPG Management Sdn Bhd

+603-92863323, +6011-12239838

LIABILITY COVERAGE

Liability insurance coverage protects you, your business and your employees from claims involving bodily injury or property damage, up to the limits of your policy. This policy also indemnifies you against the expense of out-of-court settlements, litigation and judgments awarded by courts.

PUBLIC LIABILITY INSURANCE POLICY

This policy indemnifies you against your legal liability to third parties in connection with your business, such as bodily injury and property damage to third parties property.

Public Liability Insurance Introduction

This insurance covers the legal liability of the Insured against bodily injury to third parties and loss of or damage to third parties property caused by the Insured’s negligence in connection with the business specified in the policy.

The coverage includes expenses of litigation recoverable by claimant against the Insured or incurred with the consent of the Company.

What are the Public Liability Insurance Policy covers/benefits provided?

This policy covers your legal liability to pay compensation in respect of:-

a) bodily injury to third parties

b) damage to property not belonging to or in the custody of the Insured

as a result of accident and happening in connection with your business.

In addition, this policy also cover litigation costs and expenses incurred with the written consent of the

Company.

EMPLOYER’S LIABILITY INSURANCE POLICY

This insurance indemnifies you against legal liability at law to pay compensation and claimant’s costs and expenses in respect of harm sustained by your employees in the course of employment.

Employer’s Liability Insurance Introduction

Employers may purchase this insurance which indemnifies them against their legal liability at law to pay compensation and claimant’s costs and expenses in respect of bodily injury by accident or disease sustained by the insured employees in the course of employment with them.

The coverage also includes all costs and expenses incurred with the consent of the Company.

Employees to be covered include local employees who are not eligible for contribution to the SOCSO scheme.

1. What is Employer’s Liability Insurance Policy about?

This policy covers your legal liabilities to compensate your employees for injuries by accident or disease arising out of and in the course of employment.

2. What are the Employer’s Liability Insurance Policy covers/benefits provided?

a) This policy covers your liabilities under common law for injuries to your workmen by accident or disease arising out of and in the course of employment.

b) Claimant’s costs and expenses.

PRODUCT LIABILITY INSURANCE POLICY

The policy indemnifies you against all sums which you are legally liable to pay as damages or compensation in respect of bodily injury and property damage arising out of claims made against you during the period of insurance as a result of an accident caused by anything harmful or defective in your product sold or supplied by you during the period of insurance.

Product Liability Insurance Introduction

This insurance is designed to cover the legal liability of the Insured against bodily injury and property damage to users of the insured products arising out of anything harmful or defective in the insured products (or the container thereof) which are sold or supplied by the Insured.

The coverage includes expenses of litigation recoverable by claimant against the Insured or incurred with the consent of the Company.

1. What is Product Liability Insurance Policy about?

The policy indemnifies you against all sums which you are legally liable to pay as damages or compensation in respect of bodily injury and property damage arising out of claims first made in writing against you during the period of insurance as a result of an accident caused by anything harmful or defective in your product sold or supplied by you during the period of insurance.

2. What are the Product Liability Insurance Policy covers/benefits provided?

We will pay all sums which you become legally liable to pay as damages or compensation in respect of:

(a) bodily injury;

(b) property damage

as a result of a claim first made in writing against you during the period of insurance within the Territorial Limits as a result of an occurrence in connection with your products specified in the policy schedule and we will pay all costs and expenses of litigation recovered by any claimant against you and/or incurred

with the written consent of the Insurer, subject to the Limit of Indemnity as specified in the policy schedule.

PROFESSIONAL INDEMNITY INSURANCE POLICY

This insurance provides indemnity to professionals (e.g. engineers, lawyers, surveyors, etc.) for any claim made against them for breach of professional duty.

Professional Indemnity Insurance Introduction

This insurance provides indemnity to professionals (e.g. engineers, lawyers, surveyors, etc.) for any claim made against them for breach of professional duty arising from any act, error or omission committed in their conduct of their professional services.

1. What is Professional Indemnity Insurance policy about?

Professionals who provide professional services owe a duty of care to their clients / third parties and

must exercise due care and skill. If their clients suffer financial losses after relying on their professional

advice, clients have the right to sue for the loss.

This policy indemnifies you against the breach of professional duty, by reason of any negligent act, error

or omission performed by you in the conduct of your profession.

2. What are the Professional Indemnity Insurance policy covers/benefits provided?

This policy covers:-

a) Compensation / claims made against you

b) Costs and expenses incurred

up to the Limit of Indemnity specified in the policy schedule.

ACPG Management Sdn Bhd

Head Office

158-3-7, Blok 158, Kompleks Maluri,

Jalan Jejaka, Taman Maluri, Cheras,

55100 Kuala Lumpur, Malaysia.

enquiry@acpgconsultant.com

+603-92863323, +6011-12239838

Recent Comments