Buy Online MSIG Car insurance at www.insuranceonlinepurchase.com

05 Apr 2020 Leave a comment

in Buy Online MSIG Motor Insurance, Mercedes MSIG Motor Insurance Kuala Lumpur Malaysia, MSIG E Hailing Driver Motor Insurance, MSIG Motor Insurance Cheras, MSIG 汽车保险, Perodua MSIG Car Insurance Kuala Lumpur, Uncategorized Tags: msig car insurance, MSIG Car Insurance Pandan Jaya, MSIG Car Insurance Puchong, MSIG Car Insurance Taman Maluri Cheras, MSIG Motor Insurance Ampang, MSIG Motor Insurance Cheras

线上购买 MSIG 汽车保险保单 www.insuranceonlinepurchase.com

30 May 2019 Leave a comment

in Buy Online MSIG Motor Insurance, Mercedes MSIG Motor Insurance Kuala Lumpur Malaysia, MSIG E Hailing Driver Motor Insurance, MSIG Motor Insurance Cheras, MSIG 汽车保险, Perodua MSIG Car Insurance Kuala Lumpur, Uncategorized Tags: msig car insurance, MSIG Cheras, MSIG Motor Insurance Ampang, MSIG Motor Insurance Cheras

MSIG E-Hailing Drivers Motor Insurance offer to Uber Drivers and GrabCar Drivers Whatsapp Hotline +6011-12239838

12 Jan 2018 Leave a comment

in E Hailing Driver Motor Insurance, GRAB CAR Motor Insurance, Grab Car Motor Insurance Policy, GrabCar Driver Car Insurance, GrabCar Driver Motor Insurance, MSIG E Hailing Driver Motor Insurance, MSIG Motor Insurance Cheras, Uber Driver Car Insurance, Uber Driver Motor Insurance, Uber Driver Motor Insurance Policy, UBER Motor Insurance, Uncategorized Tags: Grab Car Driver Car Insurance Policy, Grab Car Driver Motor Insurance Policy, GRAB CAR Motor Insurance, msig car insurance, MSIG Motor Insurance Cheras, Uber Driver Car Insurnace Policy, Uber Driver Motor Insurance Policy, UBER Motor Insurance

MSIG E-Hailing Motor Insurance For Uber Malaysia and GrabCar Malaysia Drivers

Whatsapp Enquiry Hotline +6011-12239838

Arranged By

ACPG Management Sdn Bhd

www.acpgconsultant.com

+603-92863323

MSIG E-Hailing Motor Insurance

MSIG First To Launch Approved E-Hailing Motor Insurance

E-Hailing Drivers Can Now Protect Themselves and Their Passengers

Kuala Lumpur, 12 December 2017 –

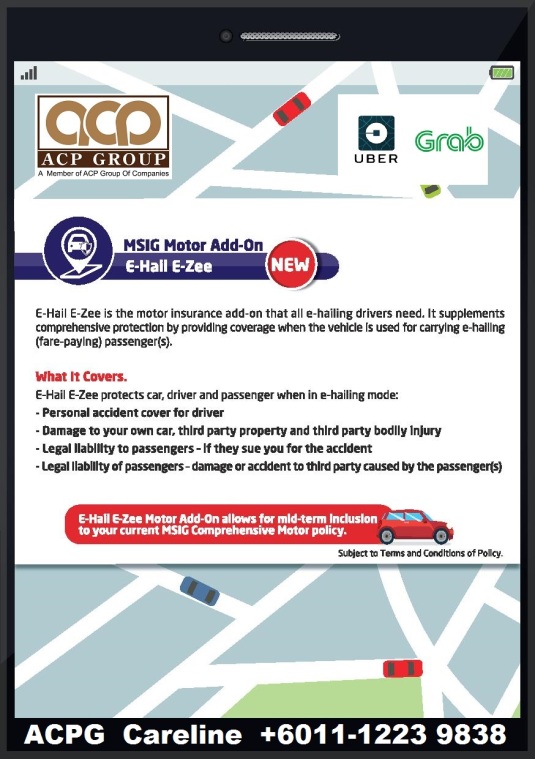

MSIG Insurance (Malaysia) Bhd (MSIG Malaysia) has launched E-Hail E-Zee, a new motor insurance add-on that is the first in Malaysia to provide e-hailing drivers with peace-of-mind in the event of an accident while they are providing e-hailing services.

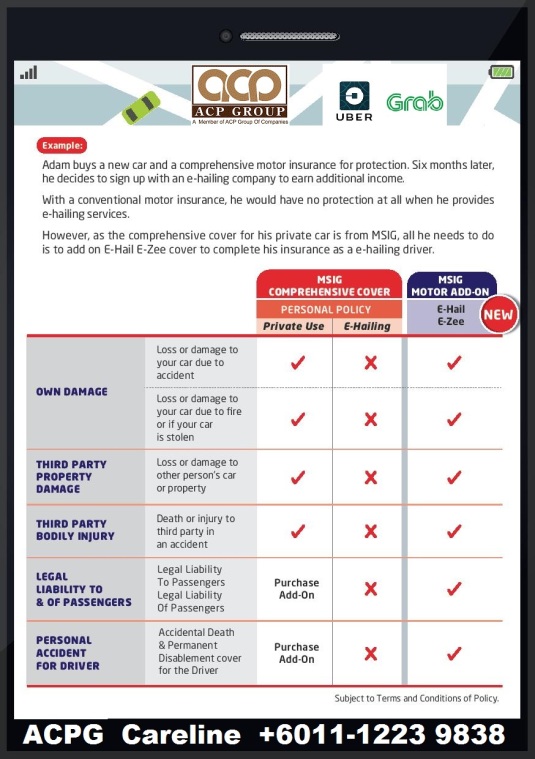

“Many drivers assume that their standard comprehensive insurance covers them in the case of an accident when providing e-hailing services, but this is not actually the case.

Until now, drivers providing e-hailing services were at great risk of substantial financial losses if they have an accident while carrying passengers, not only from damage and injuries caused by the accident itself, but also from potential legal action by passengers if they sue the driver.

Understanding the gap in the current motor policy, MSIG is proud to launch E-Hail E-Zee, allowing e-hailing drivers to protect themselves and their passengers,” said Mr Chua Seck Guan, MSIG Malaysia Chief Executive Officer.

MSIG has been liaising with various parties such as Bank Negara Malaysia and Persatuan Insurans Am Malaysia (PIAM) to create this approved add-on insurance which will enable e-hailing drivers to enjoy peace-of-mind while working.

“It has been reported* that new laws will come into place in the near future which will require e-hailing drivers to ensure that they are properly insured for e-hailing services, but they can actually purchase our E-Hail E-Zee insurance right now.

This will give them immediate protection and will still be valid when the new regulations come into force, so there is no reason for e-hailing drivers not to sign-up straight away,” said Mr Chua Seck Guan.

MSIG E-Hail E-Zee motor insurance add-on will provide authorised e-hailing drivers with the following cover when they are providing e-hailing services:

Loss or damage to the vehicle due to accident

Loss or damage to the vehicle due to fire or theft

Loss or damage to third-party’s vehicle or property

Death or injury to third-party involved in an accident

Legal liability to passengers and legal liability of passengers

Accidental Death or Permanent Disablement to the driver

The ‘Legal Liability of Passengers’ element covers unexpected negligent acts carried out by the passengers, beyond what it is reasonable for the driver to control. This could include, for example, a passenger suddenly opening their door without checking – resulting in an accident, damages or injury to other vehicles or pedestrians.

The cost of MSIG’s E-Hail E-Zee cover will vary depending on several factors, including the vehicle’s sum insured and the policyholder’s details, as it is risk-based. However, it will still be a relatively affordable add-on to the driver’s existing comprehensive insurance coverage. For example, a standard vehicle that is below 1.5 CC with full 55% No-Claim-Discount (NCD) can enjoy the coverage with an additional premium ranging between RM0.30 to RM0.70 a day.

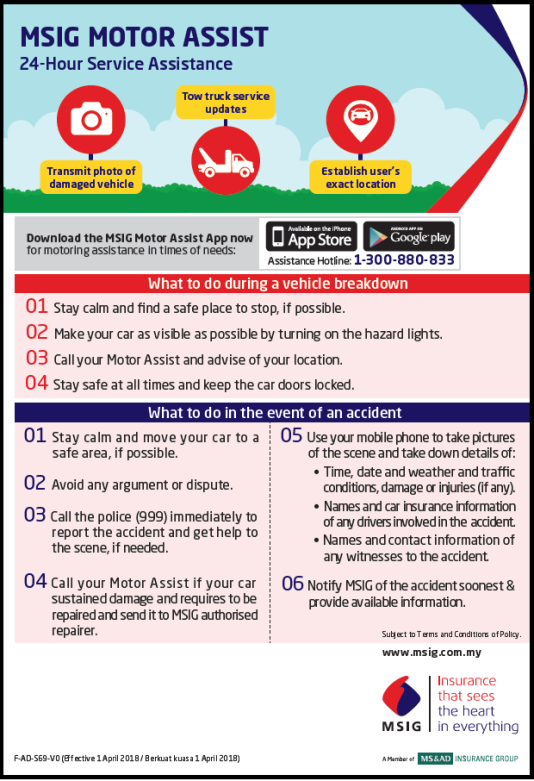

Mr Chua Seck Guan, concluded, “It is wise to have coverage to minimize the financial losses in the event of accident. E-hailing drivers can also worry less as they can continue to enjoy the same value-added services of MSIG’s Motor Assist Programme for vehicle breakdowns or accidents.”

The introduction of MSIG’s E-Hail E-Zee is one of a number of new motor insurance add-ons that MSIG has launched since the liberalisation of motor insurance earlier this year. These add-ons include: Waiver of Betterment Cost, Limited Special Perils, Smart Key Shield and Driver’s Personal Accident Insurance. They are intended for customers who want more peace of mind and to cover gaps in their current coverage.

*Reference: https://themalaysianreserve.com/…/laws-regulate-e-hailing-…/

Shared By

Anthony Chin

CEO, ACPG

www.acpgconsultant.com

ACPG Management Sdn Bhd

Malaysia Experience Risk Management Insurance Services Provider (Since Year 1989)

158-3-7, Blok 158, Kompleks Maluri,

Jalan Jejaka, Taman Maluri,

55100 Kualla Lumpur, Malaysia

.+603-92863323

enquiry@acpgconsultant.com

www.acpgconsultant.com

#acpg

#uber

#GrabCar

#UberMotorInsurance

#GrabCarMotorInsurance

#acpgmanagementsdnbhd

#ACPGMotorInsurance

#ACPGCarInsurance

#MSIGMotorInsurance

#MSIGEHailingMotorInsurance

Recent Comments