Malaysia Foreign Worker Insurance Scheme

WhatsApp for Enquiry, please click here…

Sharing Topic For Malaysia Foreign Worker Insurance Latest Update in Year 2019

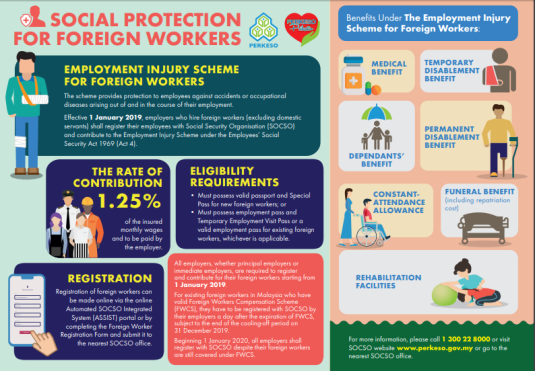

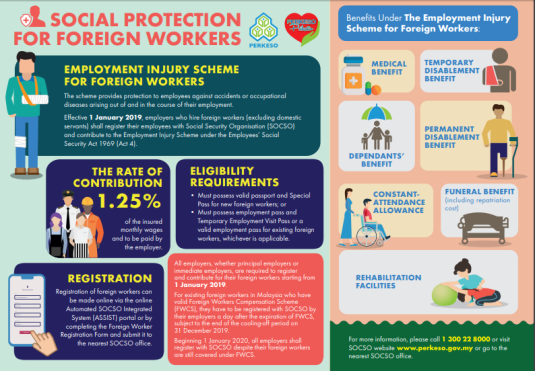

Replacement Foreign Workers Compensation Scheme (FWCS) to SOCSO Employment Injury Scheme

Starting 1 January 2019, Replacement Foreign Workers Compensation Scheme (FWCS) to SOCSO Employment Injury Scheme. SOCSO will take over the compensation for foreign workers according to the provision under the Employees’ Social Security Act 1969 (Act 4) covering the Employment Injury Scheme only.

The purpose of this Circular is to inform all employers regarding the registration procedure, submission of contribution records, payment of contribution and processing of benefit claims for foreign workers with effect from 1 January 2019.

1) From April 1993, accident compensation for foreign workers came under the Workmen’s Compensation Act 1952 (Act 273) which was enforced by the Department of Labour.

2) With effect from 1 January 2019, SOCSO will take over the compensation for foreign workers according to the provision under the Employees’ Social Security Act 1969 (Act 4) covering the Employment Injury Scheme only.

EFFECTIVE DATE OF IMPLEMENTATION

1) All foreign workers with valid insurance coverage under the Foreign Workers Compensation Scheme (FWCS), the Department of Labour Peninsular Malaysia (JTKSM), Sabah and Sarawak will continue to be covered under the FWCS until the expiry date in 2019.

2) The coverage of SOCSO’s Employment Injury Scheme will only take effect after the expiry of FWCS coverage.

3) If the maturity date of FWCS extends beyond 2019, the Employment Injury Scheme will automatically apply to all employers who employ foreign workers starting from 1 January 2020.

4) For new foreign workers working in Malaysia beginning on the 1 January 2019, employers must directly register them with SOCSO under the Employment Injury Scheme.

1) The registration procedures, submission of contribution records, payment of contribution and processing of benefit claims for foreign workers and their dependents are similar to the existing process for Malaysian citizens and permanent resident workers under Act 4. However, the following steps should be taken as follows:

a) Foreign Workers Registration

i. Employers must register their foreign workers via ASSIST portal or complete the Foreign Worker Registration Form as in Attachment A and submit it to the nearest SOCSO office.

ii. Foreign workers are eligible to be registered with SOCSO if they possess valid working permits or equivalent documents issued by the Immigration Department of Malaysia.

iii. Employers must submit supporting documents such as a photocopy of the front page of the passport containing employee details, valid working permit or entry permit or equivalent documents for SOCSO’s use.

iv. All foreign workers must register to obtain the Foreign Worker Social Security No. (12-digit KSPA No.), which is compulsory for the submission of employee contribution record.

v. The 12-digit KSPA NO. must be referred to when dealing with SOCSO on all matters related to foreign workers despite any subsequent changes to the worker’s passport details, valid working permit or equivalent document in the future.

b) Submission of Foreign Worker Contribution

i. Employers must make contribution payment based on the Second Category for the Employment Injury Scheme under Act 4, which is for the employer’s share only as in Attachment B.

ii. All foreign worker contribution payments must be made online through the ASSIST Portal or internet banking by using KSPA No.

i. All foreign workers benefit claims must submit a complete Foreign Worker Claim Notification Form as in Attachment C, together with supporting documents, and not using the existing Form 34.

ii. Foreign workers are not eligible to claim for education loan benefit, vocational rehabilitation, dialysis treatment that is not under the Employment Injury Scheme, and Return to Work programme.

iii. Foreign workers who die in Malaysia due to employment injury and are buried in their country of origin, are eligible for RM6,500 in Funeral Benefit.

iv. Other than the situation above, Funeral Benefit under the Employment Injury Scheme will be RM2,000 and is paid to eligible dependents. If there are no dependents, the amount of Funeral Benefit will be based on the amount stated in the funeral receipt, or whichever is lower.

If there are any enquiries regarding this Circular, please contact SOCSO Customer Service Centre, Headquarters (HQ) at 1300 22 8000.

Employers can also visit Socso official website, http://www.perkeso.gov.my or go to the nearest SOCSO office for more information.

SOCIAL SECURITY ORGANISATION

Employers still Compulsory need to purchase insurance scheme as below

Foreign Worker Insurance Scheme (FWIG)

Mandatory cover for your foreign worker

Taking good care of your workers will ensure the smooth running and success of your business operations. Foreign Worker Insurance Scheme, will take care of the needs of your foreign workmen while protecting your business from disruptions in the event of illnesses or accidents.

Foreign Worker Insurance Guarantee (FWIG)

Foreign Worker Insurance Guarantee is a guarantee required by Immigration Department under Regulation 21 of the Immigration Regulations from Employers as a security deposit for the employment of foreign workmen in various sectors.

In the event that any of the foreign workman(men) is/are to be repatriated to their home country, this insurance serves as a guarantee to the Director General of Immigration Department up to the maximum aggregate sum of the guarantee value.

The Insurance Guarantee offered under this scheme does not include foreign maids.

Why do I need FWHSS (SKHPPA)?

Mandatory cover for your valuable asset

Taking good care of your workers will ensure the smooth running and success of your business operations. Foreign Worker Insurance Scheme, will take care of the needs of your foreign workmen while protecting your business from disruptions in the event of illnesses or accidents.

Foreign Worker Hospitalisation & Surgical Scheme (FWHSS) SKHPPA

In view of increasing Hospital and Surgical charges, this Scheme is specially designed to reduce the financial burden of the Employers of foreign workers in the event of hospital admission of their foreign workers due to accident or illness.

Foreign Worker PA Benefits During ON and OFF Duty with 24 hours Coverage

Employers available option to purchase a supplementary Personal Accident (Foreign Worker PA) cover for foreign workers has been developed to provide 24 hours protection.

Details of cover are as below:

Accidental Death RM 25,000.00

Permanent Disablement RM 25,000.00

Medical Expenses RM 1,000.00

Repatriation of Mortal Remains RM 5,000.00

Cover 24 hours PA Coverage

Foreign Workers with valid passport and working permit.

Subject to 6%SST and RM 10 Stamp Duty per policy.

Malaysia Foreign Workers Insurance Scheme

Your Trusted Medical Insurance Advisory since year 1989

A Member of Malaysia Medical Insurance Organisation (MMI)

+6011-12239838 Whatsapp Team

#MalaysiaForeignWorkerinsurance

#MalaysiaMedicalinsuranceOrganisation

#MalaysiaForeignWorkerHospitalinsurance

#MalaysiaForeignWorkerPAinsurance

#MalaysiaForeignWorkerPersonalAccidentinsurance

Recent Comments